Using drones and photogrammetry for insurance inspections

Drone technology and photogrammetry have already disrupted traditional business and operating models across different industries. Now the insurance industry is being rebuilt with drones.

Redefining the insurance industry

In their report Clarity from above, PricewaterhouseCoopers (PwC) estimated that drone-powered solutions like photogrammetry-based surveying, could help the insurance industry save as much as 6.8 billion USD per year.

Drone-based photogrammetry helps optimize insurance-related processes, reducing the time and cost of surveys for risk assessment and claims management. Drone-mapping also adds accuracy, at the same time, reduces the risk of fraud and even improves the customer experience, with tailored premiums and faster claim resolutions.

Simplify documentation operations

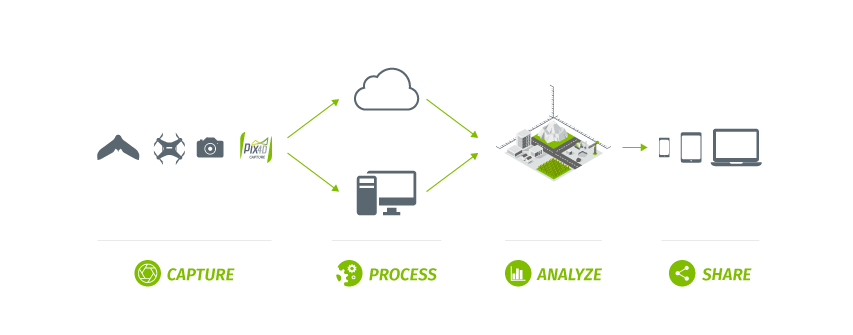

The major benefits of a drone inspection over a traditional inspection, as in property inspection scenarios, are the speed and the simplified documentation process. With a drone and Pix4D solutions, you can automate drone flights to capture high-quality images and transform them into 2D maps and 3D models. Insurers can use the improved data to document the initial state of property, infrastructure or agricultural assets, and assess and quantify damage once a claim is raised.

Facilitate risk assessment

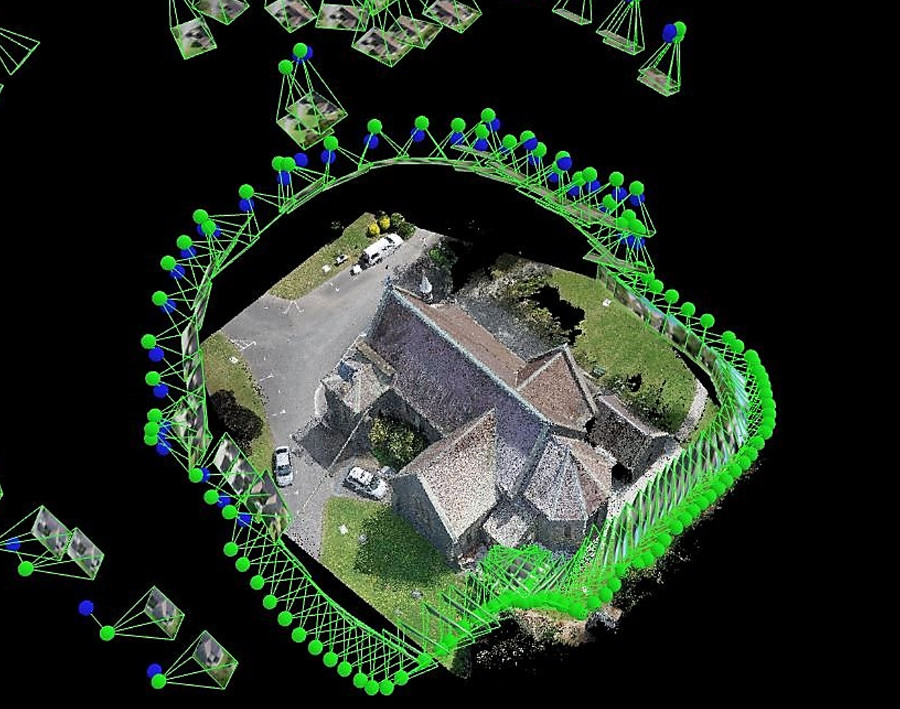

Insurance companies can use drone-mapping to generate a snapshot of an object or site, capturing its initial state before a policy is issued.

Mathew Holland, Customer Risk Solutions Advisor and Technical Lead & Chief Remote Pilot at Ansvar Insurance Australia commented: “Traditionally we had a team, manually, physically measuring everything on site, building heights, widths, distances to neighboring buildings, distances to hazards, like rivers and, it would have taken hours.

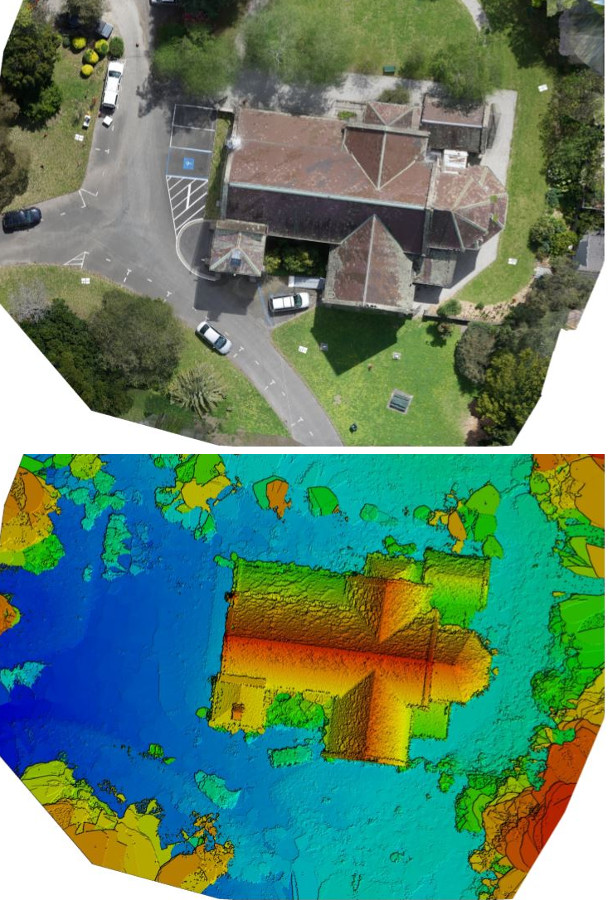

Now with a drone and Pix4Dmapper, in minutes, we can get an orthomosaic and a 3D model, where we can measure these distances and even the windows, to quantify what is actually on site, identify risks, calculate premiums, and ultimately provide clients with guidance on how to mitigate the risks that they are exposed to.

Some of the buildings we insure are churches, tall buildings with steeples, traditionally very hard to get to and very expensive to inspect.

With drones and Pix4D software, we can now quickly and safely access difficult places and obtain information we could not easily get before.

We are looking at savings in time, anywhere from 25 to 50%, and the data is more accurate than what we used to obtain manually.”

Accelerate claim management

Insurance companies can assess damage quicker, safely and more efficiently with drone operations.

“We had a storm claim, where the property was a church with a 30 meters tower, traditionally, documenting and quantifying the damage would have taken a couple of days, a couple of cranes, we would probably have closed a few roads off, and probably cost us $15,000.

With a drone, a laptop and Pix4Dmapper photogrammetry software, a drone flight and a quick processing on site, in a couple of hours, we had all the information we needed to make a decision on the claim,” said Mathew.

Monitor and reduce risks

Operational risks. Drone-mapping is a safer inspection method, that reduces the risk of work-related personal injuries and minimizes the risk of damaging client’s property while performing the operation.

The risk of fraud. According to the Insurance Information Institute, fraud comprises about 10% of property & casualty insurance losses and loss adjustment expenses every year. This statistic translates to property-casualty fraud that amounts to about $32 billion each year.

Proactive risk monitoring. Drones can be dispatched to monitor and survey disaster-prone areas and gather data for giving accurate information to residents. By partnering with governments, insurance companies can also alert residents about risks and help them minimize any loss.

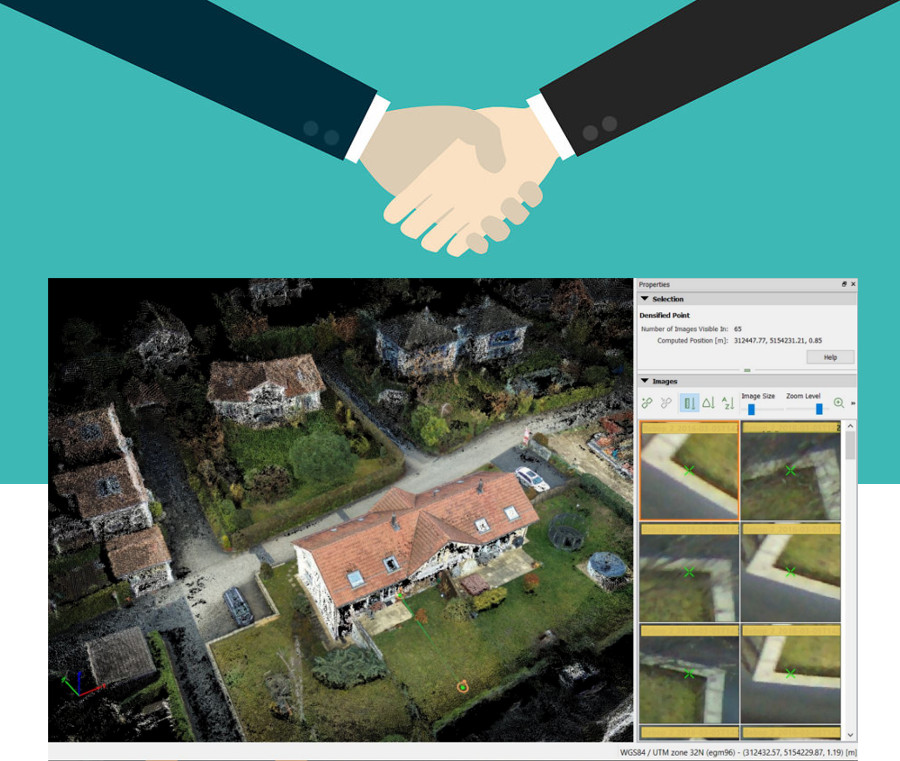

Data gathered by drones can be used to improve claims management by checking the initial state of a property and its condition after a reported incident, providing incontestable documentation and reducing the risk of fraud.

Improve customer experience

Drone-based operations benefit customers with a more personalized and faster service, translated into tailored prices, and faster claim resolutions.Drone-mapping enables personalized premiums. PwC believes drones could be used to better calculate insurance premiums by assessing risks that can’t currently be assessed efficiently. Essentially, premiums can be much more closely correlated with real threats.

By assessing risks better than ever before, insurance companies will be able to set premiums more accurately, ultimately increasing customer satisfaction.

Concretely, drone-gathered data could be used to confirm the existence of features that make properties less risky to insure, such as storm windows, or a neighborhood gate.

Save money & time, and make your clients happier

Drone-mapping speeds up inspection, reduces inspection costs, minimizes operational risks, provides incontestable documentation and at the same time enables faster and more personalized service, benefiting both, insurance companies and clients.